Investment Philosophy & Process

Alera Wealth Management follows a highly disciplined approach to help work toward your investment goals.

Our mission is to help clients accumulate long-term wealth through sound asset allocation techniques that focus on portfolio growth, while intelligently managing risk.

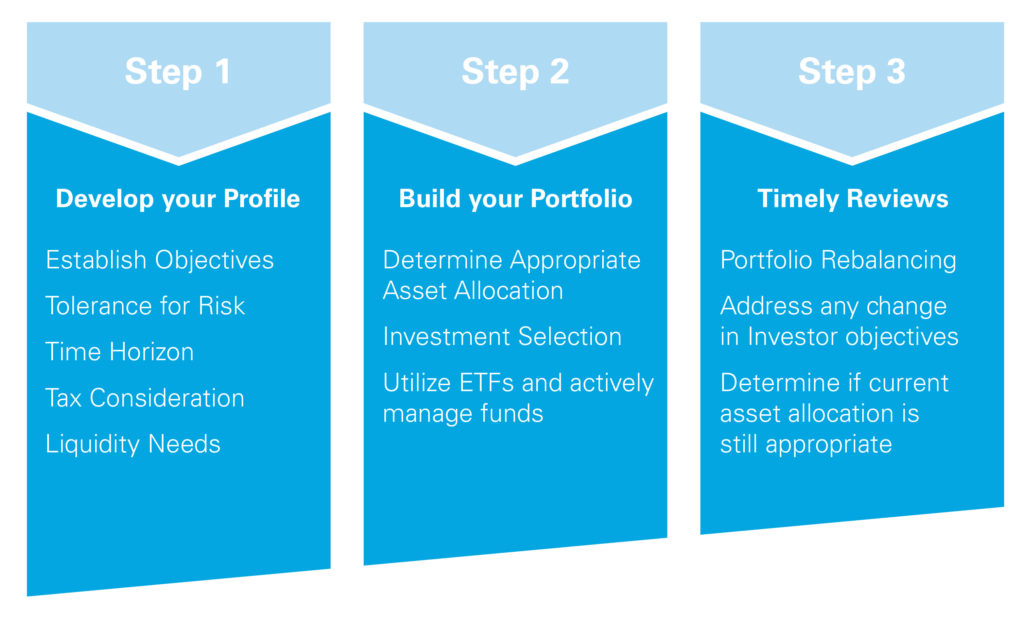

Work with your dedicated advisor to:

- Develop an investor profile to establish your objectives, tolerance for risk, time horizon, tax consideration, and liquidity needs.

- Build your portfolio by determining appropriate asset allocation. Your portfolio may contain exchange traded funds, actively managed mutual funds and/or individual securities.

- Receive timely reviews of your portfolio rebalancing, address any change in investor objectives, and determine if the current asset allocation is still appropriate.

Our recommended investment portfolio combines all the facets of our investment philosophy and process to help you pursue your long-term goals.

Three strategies are combined to create a portfolio based on your goals and risk objectives.

- Strategic growth focuses on the long-term appreciation of investment capital. The allocation will combine asset classes for optimal long-term risk performance. The time horizon should be considered greater than 10 years and clients using this strategy should be prepared for the risks associated with investments in stock markets. The ability to withstand short and intermediate term variability is required.

- Low volatility focuses on investing in fixed income investments. The portfolio is constructed to be sensitive to market and economic conditions by reduced duration and high credit quality. This strategy can be used as a stand-alone or to compliment the Growth Strategies to reduce overall portfolio risk and volatility. Time horizon should be considered as an intermediate term, or greater than three years. Possible risks would be associated with investments in bond markets. The ability to withstand short and intermediate term variability is required.

- Capital preservation focuses on high quality, short-term fixed income investments. The portfolio is constructed to primarily invest in short-term fixed income investments and current income is a secondary objective. The time horizon should be considered less than three years and clients using this strategy should be prepared for the risks associated with investments in short term bonds, including temporary loss of value and volatility. The ability to withstand short-and intermediate-term variability is required.